Investors who choose to target physical silver are presented with a plethora of purchase options. Physical silver is primarily broken down into four categories: silver bars, silver coins, silver rounds, and junk silver. This article will compare and contrast each of the four forms of physical silver:

Silver Bars

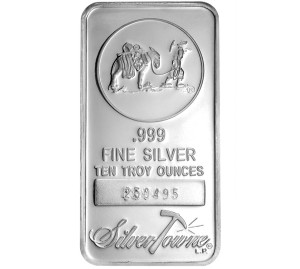

Silver bars are rectangular pieces of .999+ silver, typically ranging in weight from 1 troy ounce to 1,000 troy ounces. The most popular weights of silver bars include 1 oz, 5 oz, 10 oz, and 100 oz pieces. Below you can see an example 10 oz silver bar from SilverTowne:

Advantages of Silver Bars:

- Easily stackable, often sold in sheets of 10 or 20.

- Very low premiums, as bars can be produced by any private mint.

- Widely available in a range of sizes from 1 oz to 1000 oz due to their popularity and demand.

Disadvantages of Silver Bars:

- No face value or government backing.

- Not always IRA-approved, depending on the mint of origin.

- Different brands, even with the same weights, will not have the same dimensions.

Silver Coins

Silver coins are disk shaped pieces of metal, typically of .999 or .9999 purity. Silver coins are produced by government mints, and carry a face value in their country of origin. Coins are typically produced in weights ranging from 1 to 10 oz. Below is an American Silver Eagle – the most popular silver coin in the world:

Advantages of Silver Coins:

- Still relatively low premium, but offer a collectibility factor due to limited annual runs.

- Feature intricate and beautiful designs – may also be offered in proof form.

- Easily stacked in tubes or stored in mint “monster boxes”.

- Carry a face value in their nation of origin, typically IRA-eligible.

Disadvantages of Silver Coins:

- More expensive on a per-ounce basis than comparable silver bars or rounds.

- Only available in 1 oz and occasionally 5 oz weights.

- Occasionally go into “allocation” due to mint delays, making them hard to get.

Silver Rounds

Silver rounds are disk shaped pieces of .999+ silver, typically ranging in weight from 1 troy ounce to 5 troy ounces. The most popular weight of silver rounds is by far 1 ounce, although fractional sizes are also available on occasion. Below you can see examples of 1 oz silver rounds:

Advantages of Silver Rounds:

- Along with silver bars, offer the lowest premiums over spot on physical silver bullion.

- Easily stored, as rounds ship in mint-sealed tubes of 20 pieces each.

- Typically IRA-eligible, depending on the mint of origin.

Disadvantages of Silver Rounds:

- Offer little to no collectibility or design value, as most are quite plain in appearance.

- Typically only widely available in 1 troy ounce weights.

Junk Silver

Junk silver refers to USA currency coins of specific dates containing 90%, 40%, or 35% silver. Junk silver used to offer a very low cost method of obtaining physical, easily divisible silver, but now has become so rare that it typically features some of the highest premiums of all silver products. Below you can see example 90% silver coins:

Advantages of Junk Silver:

- Extremely divisible, sometimes in pieces as small as a nickel or dime.

- Inconspicuous, as the general public doesn’t realize these coins contain valuable silver.

- Can occasionally be found in circulating currency, offering investors a tremendous opportunity.

Disadvantages of Junk Silver:

- Nowadays, is an extremely expensive and hard to find product in the retail markets.

- Can be harder to resell, as many prospective buyers prefer shiny new silver bullion.

New vs. Secondhand Silver

Besides selecting from the different types of silver bullion, you also can choose between buying brand new pieces and buying secondhand pieces. Purchasing new silver from known dealers has an appeal for the perceived value, but the weight and silver content will match any other bar produced by a private mint, regardless of appearance. If an investor is purchasing silver for its lasting value and to add diversity to their financial portfolio, whether the bar is new or old will have no consequence on their purchase. The condition of the piece, the finish, and any visible wear is of no concern. The silver is simply bought for its value.

If an investor were to want to sell their silver bullion in the future, the status of new or old may affect the price they get as uneducated consumers may look at the worn bar as no longer worth its weight in silver. It’s an incorrect perception, but as long as an older or secondhand silver is authentic and has proper identifying marks, there is no reduction in its value. Unfortunately, some consumers will look at a shiny, new silver and choose it over a dull, worn silver. They will even pay more for the shiny piece.

If an investor doesn’t have a personal preference, new bars or secondhand bars are equally good investments.